Introduction

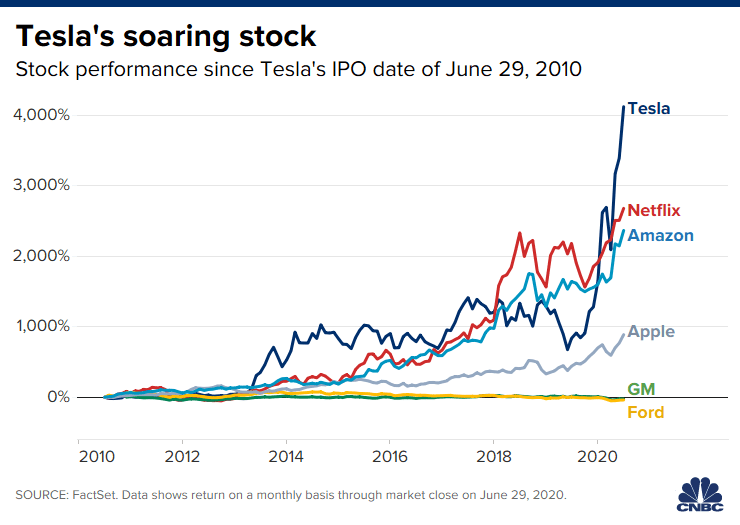

In the dynamic realm of stock markets, where trends are shaped by a multitude of factors, one can witness the profound influence of announcements on the stock prices of companies. One such illustrative scenario is the case of Tesla, where an announcement by an individual named Baird. Tesla’s stock increases

Encompassing the highly anticipated Cybertruck and other catalysts, purportedly led to a remarkable 5% increase in the company’s stock price. This article delves into the intricate interplay of events and sentiments that contribute to such market movements. Tesla’s stock increases

The Power of Announcements

Announcements, whether they pertain to product launches, earnings forecasts, or strategic partnerships, hold significant sway over investor sentiment. Tesla, a pioneering electric vehicle and clean energy company. Has consistently been at the forefront of market attention due to its innovative products and charismatic CEO, Elon Musk. Therefore, when a notable figure like Baird articulates insights regarding Tesla’s future prospects, the impact is far-reaching.

The Cybertruck Unveiling: A Catalyst for Excitement (Tesla’s stock increases)

The unveiling of the Cybertruck, Tesla’s highly anticipated electric pickup truck, represents an event that has been eagerly awaited by both investors and enthusiasts. The Cybertruck embodies Tesla’s commitment to innovation, sustainability, and technological advancement. When Baird mentioned the Cybertruck as a catalyst. It likely resonated with investors who have been closely monitoring the vehicle’s progress. The promise of a groundbreaking product can trigger positive sentiment and enthusiasm. Which in turn can lead to increased demand for Tesla’s stock.

The Concept of Catalysts in Stock Markets

In the context of stock markets, a catalyst refers to an event or factor that has the potential to trigger significant changes in a company’s performance or prospects. These catalysts can include new product releases, earnings reports, regulatory changes, macroeconomic trends, and more. When an influential figure like Baird highlights certain catalysts, it serves as a clarion call to investors to reevaluate their positions, potentially leading to increased trading activity and subsequent price movements.

The Complex Nature of Stock Price Movements (Tesla’s stock increases)

While the idea of Baird’s mention of causing a precise 5% increase in Tesla’s stock price might seem straightforward, the reality is far more intricate. Stock prices are shaped by a confluence of factors, including market sentiment, economic indicators, geopolitical events, and broader industry trends. Investors often analyze a multitude of variables before making trading decisions. An announcement is just one piece of the puzzle, and its impact can vary based on the context and timing of the market.

Market Psychology: The Investor Response (Tesla’s stock increases)

Market psychology plays a pivotal role in shaping stock price movements. Investors’ perceptions of the company’s future prospects, as well as their collective response to announcements, create fluctuations in the market. Positive news can fuel optimism and lead to a surge in buying activity, while negative news can prompt a sell-off. Baird’s statement likely tapped into the psychology of excitement and anticipation surrounding the Cybertruck, thereby contributing to the reported stock price increase.

Conclusion

In the intricate world of stock markets, the relationship between announcements. Stock price movements is a complex and multifaceted. While it’s intriguing to envision a scenario where an individual’s mention of catalysts leads to a specific percentage increase in a company’s stock price.

The reality is governed by a myriad of interacting variables. The interplay of market sentiment, investor psychology, industry trends, and economic indicators creates a tapestry of factors that shape stock price movements.

The case of Tesla and Baird’s mention serves as a reminder. Stock markets are not merely driven by individual statements or isolated events. They are a reflection of the collective wisdom and actions of a diverse array of investors and traders. Each with their own motivations, strategies, and perspectives.

Understanding the intricate dynamics of stock price movements requires a holistic perspective that considers both the micro and macro influences that contribute to market trends. As we continue to observe the evolving landscape of finance. It is important to approach narratives of market movement with a nuanced understanding of the broader context.

+ There are no comments

Add yours